When it comes to different types of tax forms, the most common are T4’s, T4A’s and T4Es. Each of these different types represents a different type of income. While you don’t need the form to file your taxes, you do need the information on the form.

What is a T4E?

A T4E is similar to a T4. However, it’s for those who received benefits from the Employment Insurance Program and other income benefits during the tax year. It’s also referred to as a statement of employment insurance. These benefits that can be included under these EI payments include:

- COVID-19-related payments

- Employment Insurance benefits

- Work-sharing benefits

- Financial assistance benefits for an approved employment program

- Maternity and parental benefits

- Tuition Assistance

When you receive your T4E, it will indicate how much you were paid as well as how much income tax was paid. You will then give this information to your accountant or input it into your tax software.

T4 Vs T4E

T4’s, also known as a Statement of Remuneration Paid, is issued by your employer and breaks down how much you’ve earned in the calendar year. It also breaks down what portion of your income went to tax, CPP, EI, and any other deductions that were made. This differs from the T4E, because the T4E is issued by Service Canada and the Canada Revenue Agency. That said, both of these forms give you a breakdown of your annual income.

T4A Vs T4E

When it comes to T4A’s in Canada, you can receive them for a variety of reasons. One of the most common reasons to receive one is for a government pension. You’ll receive a pension for both the Canada Pension Plan and Old Age Security income. You’ll also receive a T4A if you’re a self-contractor or if you receive a workplace pension.

T4E, on the other hand, are only received from the Canada Revenue Agency. You’ll only receive one if you receive EI benefits or need to make an EI overpayment. This is different from a T4A since those can be administered by the CRA or by a contractor—even a company from which you receive your pension payments.

Line 11900 on Your Tax Return

If you’re filing your own tax return, it is important to make sure you put the correct income amounts in the correct space. There are many different sections where you enter different parts of your income, and one of these is line 11900. This line is where you enter the income earned on your T4E. This is the amount shown in box 14 of your T4E.

Getting Your T4E

If you’re supposed to be receiving a T4E, then it should be mailed to you in February for the current tax year. In order to receive this, though, it’s important to be sure that the CRA has your correct mailing address. That said, sometimes, you might not receive it. If that’s the case, then it can be found on your My Service Canada Account.

In order to access your My CRA Account, you do have to be registered. If you aren’t, then you should contact the CRA. They’ll be able to either resend you the information or get you registered for a My CRA Account. If you’re doing your taxes through a software program or an accountant, you can also have these forms directly uploaded, which means that they will auto-enter the tax information that you need.

When T4E’s Are Issued

In Canada, all T4s are required to be filed and mailed out by the end of February. Due to this, the latest that you should receive your T4E is mid-March. This gives you plenty of time to file your income tax return before the due date of April 30.

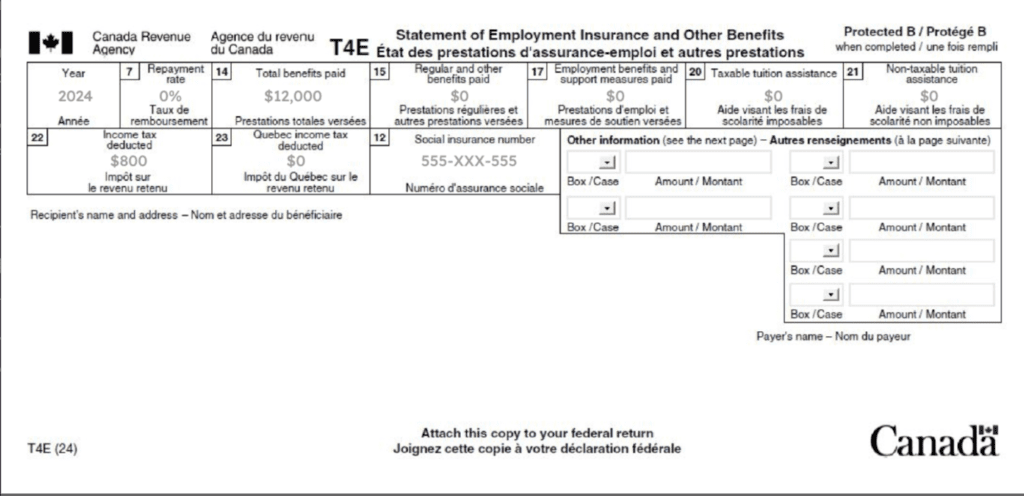

Example of a T4E

When you receive a T4E slip, there are quite a few boxes that could be filled out. It’s important to remember that not all of the boxes need to be filled out, only the ones that pertain to your specific tax situation. That said, here is each box and what should be included in each.

| Box # | Information | Details |

| 7 | Repayment Rate | If the funds you were paid need to be repaid, this is the rate of repayment. |

| 14 | Total Benefits Paid | Includes all amounts in boxes 15,17,18,33.36.and 37 |

| 15 | Regular and Other Benefits Paid | This includes work-sharing benefits. |

| 17 | Employment Benefits and Support Measures Paid | Employment insurance-funded financial assistance. |

| 18 | Tax Exempt Benefits | This applies to Indians registered or eligible to be registered under the Indian Act. |

| 20 | Taxable Tuition Assistance | Used to claim a tuition tax credit |

| 21 | Non-Taxable Tuition Assistance | Amount that doesn’t qualify for a non-refundable tax credit. |

| 22 | Income Tax Deducted | This amount is entered in line 43700 of your income tax return. It’s the total income tax withheld. |

| 24 | Non-Resident Tax Deducted | This amount is entered in line 43700 of your income tax return. |

| 26 | Overpayment Recovered or Repaid | Amounts that were applied to an overpayment. |

| 27 | Reversal of Income Tax Deducted | Reversal of income tax on a repaid amount. |

| 30 | Total Repayment | The amount is to be entered in line 23200 on your return. |

| 33 | Payments out of the Consolidated Revenue Fund | Included in Box 14. |

| 36 | Provincial Parental Insurance Plan Benefits | Included in Box 14. |

| 37 | EI Maternity and Parental Benefits Payment | Included in Box 14. |

Here is an example of someone who received Employment Insurance benefit payments for being unable to work due to no fault of their own. These form needs to be filed in order to make sure the person has the correct tax implications.

Claiming Income Tax Refunds While on EI

Just like many other forms of income that you can receive in Canada, Employment Insurance benefits in Canada are taxable. This means that you do have to file them on your income tax return. In fact, most payments that you receive in Canada, whether they are considered taxable income or not, will still have to be reported on your annual income tax return.

What to Do If You Don’t Receive Your T4E?

With the T4E being your statement of Employment Insurance and other benefits, under the Employment Insurance Act, you’ll likely receive this for benefits repaid and overpaid EI benefits. You could also have received one in previous tax years for the Canada Emergency Response Benefit. Even if you aren’t paying income tax on these amounts, you still have to claim it on your tax return.

If you have not received this itemized statement for gross payments issued but the due date, then the best thing you can do is contact Service Canada. They can find your form or issue another copy if needed. You may also receive an updated statement if any amounts were deducted incorrectly, and amounts owed to you will be deposited into your bank account. You should be able to see this through online banking.

Filing Your Annual Income Tax Return

When it comes to filing your income tax return, you can choose to hire a tax professional or file your taxes yourself. If you choose to do it yourself, there are plenty of different tax software options available.

While it may seem complicated to file your tax return, software programs actually make it very simple. It guides you through each step you need to complete and the information required for each step. At the end of the process, they also allow you to do a full review before you Netfile them with the CRA.

How To File With More Than One T4

Filing with more than one T4 is actually simpler than you may think. If you’re filing with a tax professional, then all you have to do is give them the required information. If you’re filing on your own, tax software can walk you through it. In each program, there are sections where you can add your information for each different type of T4 and open multiple tabs for similar T4s.

In the tax software program, you can select any type of income that you need to file along with your T4s, including self-employment income and rental income. When you do this, the program will allow you to input all relevant information before completing your tax return. However, it is important to remember that the more complicated your tax return is, the more it will cost to file. This is the case whether you file using tax software or a tax professional.

What Happens If You Don’t File Every Year or File Late?

When it comes to income taxes, it’s important that you file every year and on time. This is because you could be subject to a penalty for filing late. If you receive government benefits, you can also lose those payments by not filing your taxes. For many government benefits, filing your taxes is a requirement. This includes the Canada Workers Benefit, which is an employment program that offers an income supplement to low-income workers.

If you are late or haven’t filed your taxes, don’t stress. That doesn’t mean that you can’t file or receive these payments. You can still file at any time and have everything documented. In a case like this, any benefits you may have qualified for will then be paid to you. If you happen to owe money on your annual tax return, then there will be a penalty and interest on that money you will also be required to pay. If you can’t pay the funds upfront, you can make arrangements with the CRA to make the payments over time.

Keep in mind that the CRA still allows you to file and amend tax returns from previous calendar years. If you no longer have the benefit slips to file, then you can find them on your My CRA Account or request a copy. These slips will show you the amounts paid as well as your gross amount. They may even show eligible expenses that you can claim. Even if you have a new job, you can still request these documents from your previous employer.

Final Thoughts

Filing your tax return during tax season can actually be very stressful. There are many different factors that will affect your tax situation, and each of these is individual to everyone. No two people will have an identical tax situation. Because of this, there are tax professionals available to help you navigate your return.

That said, whether you file your own return or not, you still need to be aware of which documents you need in order to file. This includes pension information, T4s, and T4Es. While you should receive most of these documents automatically, it is important to be aware of this in case you don’t receive them and need to request them. d to request them.