What exactly is this form? Well, it provides your employer with information about how much income tax to What exactly is this form? Well, it provides your employer with information about how much income tax to deduct from your paychecks. This can prevent you from having to pay extra income tax when the tax season comes around. Some people choose to stick to the basic personal amount, while others have to modify it based on their financial situation.

Different TD1 Forms in Canada

In Canada, everyone fills out the same federal TD1 forms for legal employment. However, because you’re taxed differently based on the province you live in, you’ll also get a separate TD1 form for your provincial income taxes.

Each province or territory will have a different TD1 form. You’ll also likely have to fill out these forms again every year. New employees who don’t fill out a TD1 will get a penalty of $25 per day. The minimum penalty is $100, and the maximum penalty is $2,500.

What to Claim on your TD1

What you claim on your TD1 will depend on your financial situation. That said, though, everyone will claim the basic personal amount of $16,129 for 2025. From there, you can claim more tax if you work more than one job, or you can claim some of the different credits available to you to save more money (as long as you’re eligible).

- Disability Tax Credit for up to $10,138

- Pension income amount for up to $2,000

- Age amount for up to $9,028

- Caregiver for infirm children for up to $2,687

- Caregiver for an infirm spouse or common-law partner for up to $2,687

- Caregiver for infirm dependents over 18 for up to $8,624

- Tuition fees

- Northern Residents Tax Reduction

It’s important to remember that what you claim on your TD1 is just an estimate to give the federal government a more accurate picture of your financial situation and calculate the appropriate amount of tax deducted, as well as your average tax rate.

It’s entirely possible that once you file your annual income tax return, you may have to pay more income tax or receive a tax refund because you paid too much tax.

Basic Personal Amount on Your TD1

We mentioned above that everyone puts down the basic personal amount as a minimum when filing their annual income tax return. The basic personal amount for your federal TD1 is $16,129. This means that you won’t be required to pay tax on the first $16,129 that you earn. This is why this is also often referred to as the basic personal exemption amount.

Did you know that the provincial basic personal amount changes based on where you live? Let’s take a look.

| Province/Territory | Basic Personal Amount |

| British Columbia | $12,932 |

| Alberta | $22,323 |

| Saskatchewan | $19,491 |

| Manitoba | $15,780 |

| Ontario | $12,747 |

| Quebec | $18,571 |

| New Brunswick | $13,396 |

| Nova Scotia | $11,744 |

| Prince Edward Island | $14,650 |

| Yukon | $16,129 |

| Nunavut | $19,274 |

| Northwest Territories | $17,842 |

| Newfoundland and Labrador | $11,067 |

How to Fill Out a TD1

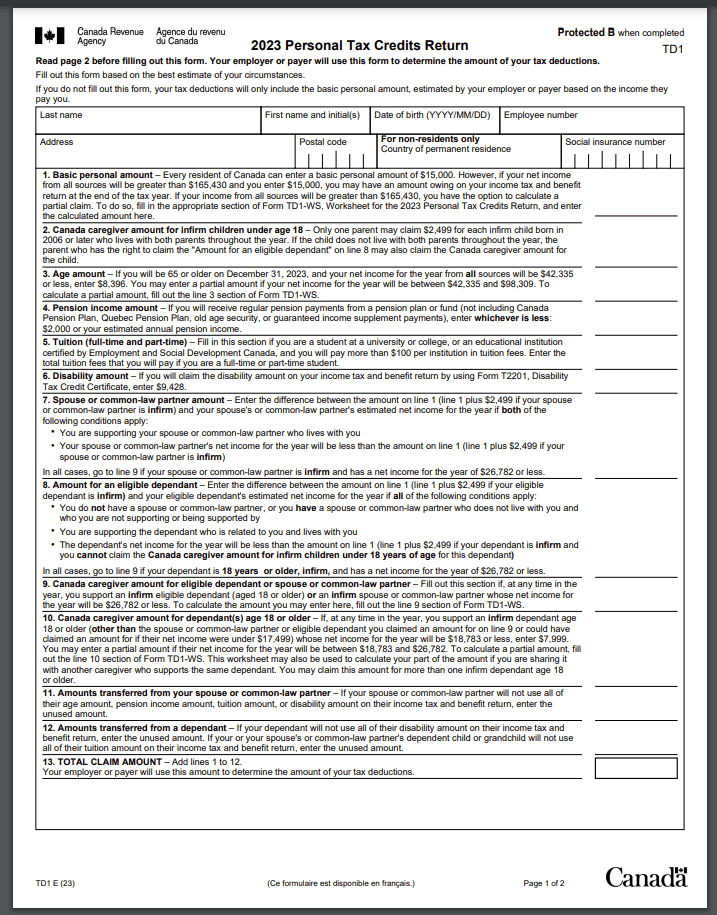

Now that we’ve gone over some of the tax credit claims you can qualify for, let’s go over how you would fill out the actual TD1. All provincial forms vary slightly, but the basic premise is the same. The one that’s universal for all Canadians is the federal TD1, so we’ll go over that one in detail.

With the federal TD1, you’ll see two forms: the TD1 and the TD1-WS (also known as the worksheet). The worksheet is what you fill out to give your employer and the government a breakdown of your financial situation in order to determine how much tax should be taken off.

Like with any government form, you start by filling out your name and address. Because it’s a tax document, you’ll also be required to enter your SIN number. From there, you fill in the boxes and the worksheet if you’re required.

| Box | Information Required |

| 1 | This is the basic personal amount. For the federal form, this will be $15,000. |

| 2 | You fill in this box if you’re claiming the Canadian caregiver amount for children under 18 with disabilities. |

| 3 | Box 3 is for the age amount. You claim this if you’re over 65. The total amount you enter here is based on your annual income. |

| 4 | If you receive pension income, you can claim up to $ 2,000. If you receive less, then you’ll enter that amount instead. |

| 5 | You fill this box out whether you’re a part-time or full-time student. Enter any amount you pay for the year over $100. |

| 6 | Here, you enter your disability amount. This box is only required if you’ve been approved for the disability tax credit. There’s only one amount, so you’d enter that. |

| 7 | This is the spouse and common-law partner box. You only fill this one out if you make less than $15,000 annually. If they’re disabled, then you enter the amount you’re allotted to claim for that, |

| 8 | This box is for dependent children. You can deduct what they make from $15,000 and claim the difference. |

| 9 | If you have a spouse or eligible dependent with disabilities, this is where you enter the amount. You’ll also be required to fill out the worksheet. |

| 10 | This is also for a Canadian caregiver amount, but you only fill it out if you support a disabled individual over 18 who earns an income of $18,783 or less. |

| 11 | This is where you can transfer up to $5,000 to your spouse or common-law partner. |

| 12 | This box is to enter any amounts transferred to you from a dependent. You can enter up to $5,000. |

| 13 | Here, you enter the total claim amount of the other 12 boxes. |

These are just the things you can claim before your taxes are deducted. When you file your income tax return for the fiscal year, you can make other claim amounts for things like employment expenses, RRSP contributions and child care expenses. These deductions will allow you to pay less tax and receive a tax refund.

TD1 Form Example

To give you a better idea of what a TD1 looks like, here’s an example.

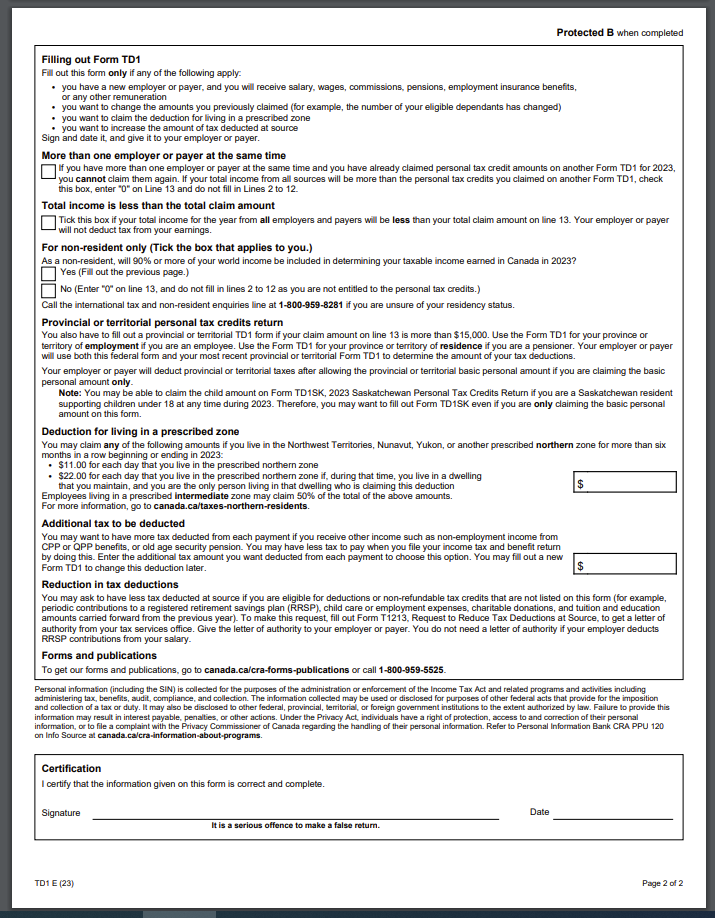

As you can see, you’ll start by filling in your personal information at the top. Once that’s done, you’ll enter the basic personal amount and then fill in any other claim amounts you qualify for. On the second page, there will be a few more questions for you. This is where you’ll claim if you have more than one employer and if you want to deduct any additional tax.

On page 2, you can also see whether or not you live in a prescribed zone. If you did it for more than 6 months, then you can claim the appropriate amount. There’s also a section for non-residents. Then, you’ll sign and date the document.

Filling Out a TD1 When You Have Two Jobs

With two jobs, filling out your TD1 can be confusing, but it’s relatively simple. You want to be sure that your employers take off enough tax, so you would fill out one of the TD1s and claim all of your applicable tax credits.

On your second form, you’ll just select that you have more than one employer. This is because tax amounts are deducted based on your total taxable income, not just your employment income, but also other income, and taking too much tax would result in you having to pay.

Putting 0 on a TD1

The only time you’ll put a zero on your TD1 is if you have multiple employers; the total income will be more than the personal tax credits already claimed on another TD1. You’ll leave boxes 1 through 12 blank and put 0 in box 13. On the second page, you’ll tick the box that says you have more than one employer. You’ll do this as a new hire, but also every year and change it if necessary.

Filling Out Your TD1 Online

While TD1s used to be entirely done on paper, they can now be filled out online as well. If your employer does require an electronic copy of your TD1, they will send it to you. It’s the same process as a paper copy. You just fill in the information required and then hit submit.

Filling Out a TD1 for a New Job

For most people, the TD1 is going to have the standard income tax deducted, which is the basic personal amount of $16,452 for 2026. This will change based on the year that you’re filling out the form. That said, using this form, you can reduce your tax deductions, also known as payroll deductions, by adding in any additional tax credits that you qualify for. In fact, if you’re requesting to have additional tax taken off due to having multiple jobs, this form allows you to do that as well.

TD1 Tuition Amount

If you’re a student, you can claim some of your tuition fees on the TD1 form. However, you can only do this if your tuition fees exceed $100 in the calendar year. If you’re a full-time student, then you can claim the amount of $400 on your TD1. This is done in Section 4, on line 5.

What is the Total Claim Amount on the TD1?

The total claim amount is found in different places depending on whether or not you’re filling out the provincial form or the federal form. On the federal form, this is line 13, and on the provincial form, this is line 11. Essentially, though, it is the final sum that is entered on the form in order to calculate your tax deductions.

What is TD1 Line 8?

If you’re claiming an amount on line 8, this is in order to claim an amount for an eligible dependant. However, this is not the box you’re claiming if you’re claiming your spouse as a dependent. This is the amount you claim if you’re claiming the amount equivalent to the spouse amount if you have a dependent child or other dependent.

If you’re claiming this amount, keep in mind that you can’t have a spouse or a common-law partner. You can also only claim this for one child/dependant.

What is the Federal Amount From a TD1?

When they’re referring to the federal amount from the TD1, this is the federal basic amount of $16 452. This will be found on all TD1 forms that include federal information and will help your employer determine how much tax should be withheld every pay period.

How to Fill Out a TD1 Form as a Student

As a student, you will have a few more deductions than someone who isn’t in school. If your total annual income is less than $181,440, then you enter the basic personal amount of $16,452. Under line 5, you’ll enter your tuition amount unless your amount is less than $100. If you earn under $16,452, then you tick the box that says exempt from tax deductions.

Whether you attended post-secondary school or are still in high school, you will have to fill out provincial or territorial form TD1, as well as the federal one, if you’re employed. That said, the above way to fill out the form is a generalization. Your net income, employment status, and personal circumstances will influence how you fill out the TD1.

How to Fill Out a TD1 By Province

Depending on where you live in Canada, each province or territory is going to have its own TD1 on top of the Federal TD1 form. This form is going to be the same as the federal form for every province; the only difference is going to be the basic personal amount.

This is because each province has a different basic personal amount than the federal government. The federal BPA is for your federal income taxes, and the provincial or territorial BPA is for your provincial or territorial income taxes.

Who Has to Fill Out TD1 Forms in Canada

While not everyone who receives an income needs to fill out a TD1, most people do. This is because not all income is taxable. If you receive taxable income, then you need to fill out a TD1. Even if you’re considered to be tax-exempt, you still need to fill it out. For example, if you receive pension payments, you will need to fill them out. Even those who are temporary workers or have residency status will fill one out.

However, how you fill out the form is based on your personal situation. As the only person in the house who has dependants, you can claim the Canada Caregiver amount under deductions. It can also change your tax situation if you’re a student. Once this is all done, the completed form, your personal details, and tax tables will be used to calculate what you owe. This is recalculated by the CRA when you do your taxes.

Overview

TD1s are required so your employer and the Canada Revenue Agency can accurately estimate how much tax to take off your pay annually. You will have to fill out a new form when you get a new employer or once a year to update your file, since your situation may be different from the previous year. Not only will you have to fill out the federal TD1, but the provincial TD1 as well.

While these forms are usually done manually, you’re now able to fill them out online with some employers. It just depends on what method they prefer. If they do prefer the electronic version, they will send you a copy.

No matter which version you fill out, though, it’s important to remember that you want to fill out these forms as accurately as possible to ensure the correct amount of tax is taken out. While getting a refund during tax time would be okay, you don’t want to have to pay extra tax when you file your taxes. nd during tax time would be okay, you don’t want to have to pay extra tax when you file your taxes.